In the contemporary financial landscape, understanding the intricacies of your pay stub is essential. Surprisingly, many of us have no clue how to read pay stubs or know the meaning of various codes listed. It can be extra confusing if you work at a construction company that pays prevailing wages on their federal projects, or for union contractors that track dues and fringes.

eBacon is an easy-to-use software platform to manage your time, HR, and payroll in one place. This gives you access to single-click certified reporting. GET A FREE DEMO OF eBACON TODAY.

Unveiling the Basics of Your Pay Stub

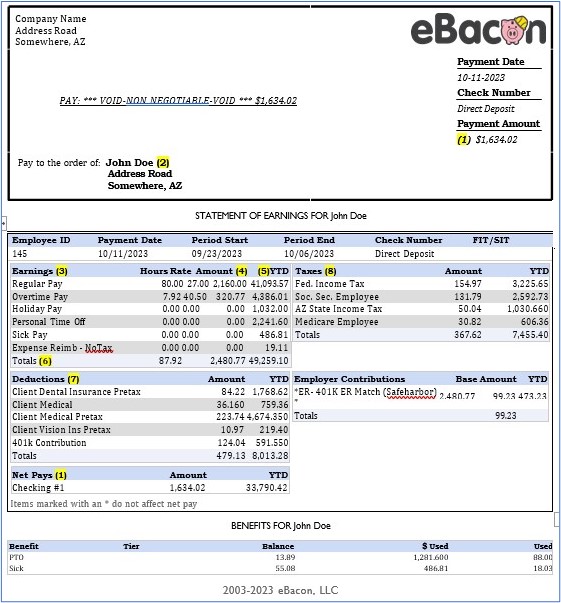

To break it down, we should start with the simplest pay stubs and examine sections common for nearly every business. Whether through direct deposit or traditional means, your stub will likely include your company name, payment date, check number, and pay period covered.

Navigating the Payment Amount

Of course, when you receive your pay stub, the first thing your eyes naturally go to is your Payment Amount (1). This is the same as your “Net Pay,” or your total take-home pay after removing all deductions.

Ensuring Accurate Personal Information

You should periodically check your name and home address (2) to ensure they’re still current. Your payroll department needs this information to mail you your year-end W2 tax form.

Regular Pay Stub Image

Understanding the Statement of Earnings

The focal point of many pay stubs is the Statement of Earnings (3), encompassing payment for hours worked. This section delineates totals for regular hours, overtime, holidays, PTO, and more. Additionally, the system clearly outlines your hourly rate and applicable overtime rate.

Earnings Overview:

The Earnings Overview (4 & 5) is a breakdown of earnings for the current pay period and Year-to-Date (YTD) facilitates a comprehensive view of your income for the tax year.

Earnings Totals:

The Earnings Totals (6), is the Gross Pay for the entire week, this line incorporates per diems, commissions, bonuses, reimbursements, and more, before any deductions.

Scrutinizing Deductions

mirrors similar patterns across pay stubs, presenting employee-mandated charges (e.g., child support) and voluntary deductions (e.g., health insurance). Both periodic and YTD listings provide clarity, with the “Deductions Totals” line showcasing the cumulative amount deducted from your paycheck.

Calculating Net Pay

The total of the “Net Pays” (7) section should match the check’s Payment Amount. It can be split between direct deposit checking or savings accounts, live checks, or pay cards. The total Net Pay is Gross Pay, minus Deductions, and minus Taxes.

Unveiling Tax Breakdown

The “Taxes” (8) section breaks down individual federal, state, or local taxes being withheld. Again, this area has a current and YTD column and adds up the total of all taxes.

Our Regular pay stub [above] shows a typical check with federal withholding, Social Security, Medicare, and state income taxes.

All workers are required to have Social Security and Medicare, while federal and state taxes may change based on your individual exemptions.

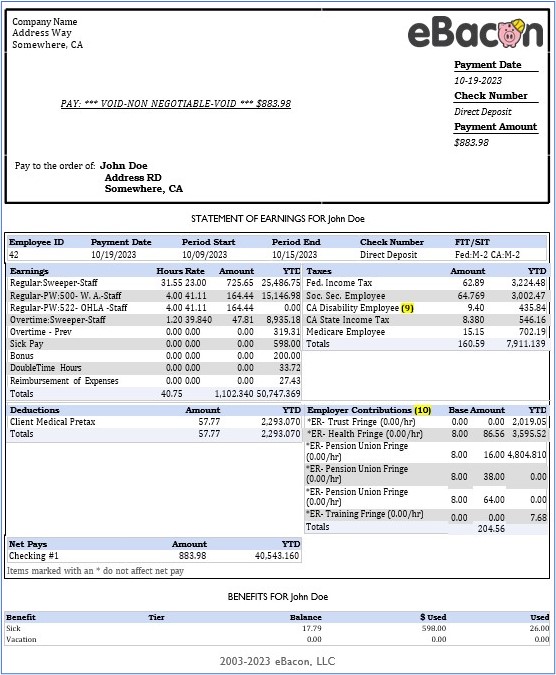

Depending on your location, your state or city may require additional taxes. One example is our Union pay stub including Disability Employee (9) taxes and California state taxes.

Union Pay Stub Image

Insights into Employer Contributions

Employer Contributions Overview:

Beyond direct compensation, the Employer Contributions Overview (10) section encapsulates employer contributions such as a 401k match.

Union-Specific Considerations:

Union contractors may observe additional employer contributions dictated by collective bargaining agreements, channeling dues, and fringe funds to the union.

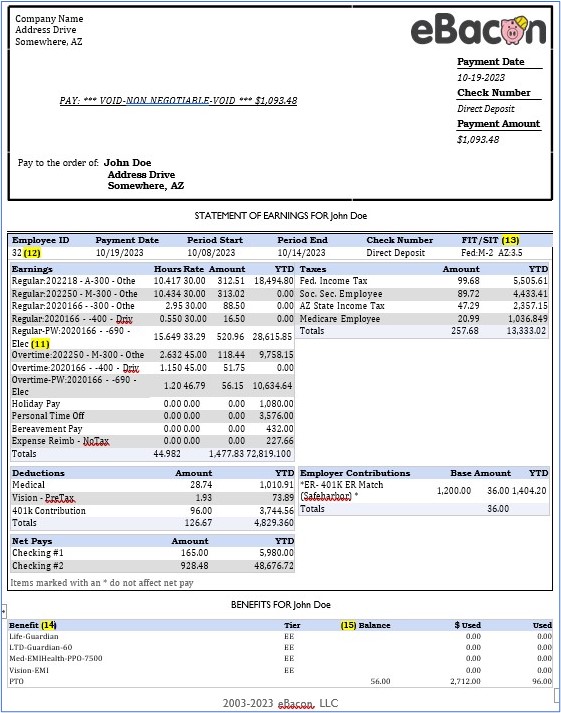

Deciphering Prevailing Wage Pay Stubs

If you’re working on a prevailing wage job, you may see your hours split by regular, overtime, and other codes. “PW” (11) is the code eBacon uses to denote prevailing wage pay subject to Davis-Bacon laws, but businesses may use their coding. Many companies, however, split lines by job to allow their managers to monitor a job’s progress, or for accounting to bill the contracting agency for work done on that particular job site.

Keep in mind that PW pay rates may differ from your regular rate because the Department of Labor sets wages and fringes based on a wage determination for employees. An employer covers fringe benefits, such as contributing to health insurance, accrued vacation, or other funds, as part of your compensation. Your payroll administrator can break down the amounts for you.

Prevailing Pay Stub Image

Additional Pay Stub Insights

While every company has its way of printing a pay stub with the information they feel is important, there are a few universal things:

- Gross Pay – Taxes – Deductions = Net Pay.

- Employees do not add or deduct employer contributions, also known as fringe benefits, from gross pay. added to or deducted from gross pay.

Optional information on Pay Stubs

Employee ID:

The Employee ID (12) is variable across companies, this identification facilitates record-keeping.

FIT/SIT:

A FIT/SIT (13) category recognizes individual tax exemptions, such as the number of dependents.

Benefits Enrollment Choices:

Outlining Benefits Enrollment Choices (14) is related to benefit plans.

PTO, Vacation, or Sick Pay Balance:

The PTO, Vacation, or Sick Pay Balance Category (15) provides insights into accrued time off balances.

Seeking Clarification

If you encounter uncertainties or note discrepancies in your pay stub, it is advisable to reach out to your payroll administrator. They can provide the necessary assistance to ensure clarity and accuracy.

Get Started with eBacon Today

General Pay Stub Questions and Answers

What do the codes mean on my pay stub?

The three main parts of your pay stub are your pay amount, the taxes you owe, and any other amounts that are taken out. Look at your gross, year-to-date, and net income. The amounts that are taken out for taxes are usually the hardest to understand, especially the ones for FICA.

What do most of the codes mean on my pay stub?

These are the most common codes for deductions on your pay stub:

FED, FIT, or FWT: How much federal income tax is taken out

State, SIT, or SWT: How much state income tax is taken out

FICA: FICA taxes for Medicare and Social Security

YTD: How much you have earned so far this year

MED: How much is taken out for health, vision, or dental insurance

INS: How much is taken out for other types of insurance, like life insurance

401(k) or RET: How much you put into a 401(k) retirement plan

FSA or HSA: How much you put into a flexible spending account (FSA), or a health savings account (HSA)

How do independent contractors make pay stubs?

Independent contractors have to create their pay stubs from the information on their Form 1099-NEC because employers do not give them one. They can use an independent contractor pay stub template for each client and complete it to receive the payment for their work.

Stay Ahead with Winter Payroll Considerations for Construction: Expert Tips and Tricks

Winter weather creates unique winter payroll challenges for the construction industry. Learn how to handle cold weather gear deductions and…

Fostering a Positive Construction Work Environment: Tips for Improved Morale

Discover essential tips to create a positive construction work environment. Learn how to boost morale, improve safety, and enhance productivity….

Davis-Bacon Compliance for Accountants and CPAs: An Expert Guide

A comprehensive guide for Davis-Bacon compliance for accountants and CPAs. Learn how to ensure compliance and avoid penalties for the…

Payroll Challenges in Construction: Ultimate Guide to Compliance Success

Learn how to address payroll challenges in construction with practical tips on avoiding misclassification, resolving wage disputes, and ensuring compliance….

Construction Apprenticeship Programs: Empowering a New Generation of Builders

Discover the benefits of construction apprenticeship programs. Build a skilled workforce, address labor shortages, and ensure industry success with our…

Construction Site Emergency Action Plans (EAPs): Transform Your Safety Protocols with This Ultimate Guide

For construction companies, developing effective construction site emergency action plans (EAPs) is paramount. These plans are essential for protecting workers,…

The material presented here is educational in nature and is not intended to be, nor should be relied upon, as legal or financial advice. Please consult with an attorney or financial professional for advice.